Maryland’s Labor Market and Labor Force

With the national economic recovery poised to become the longest on record, and Maryland’s unemployment rate at 4 percent, finding the workers needed to support and grow operations has become increasingly difficult for businesses. In the Maryland Business Climate Survey, the JFI included more focused questions on how the local labor market is impacting business operations. It asked questions on how labor market conditions are impacting business operations, worker shortages, recruitment, and satisfaction with Maryland’s education system.

Labor Market Conditions

The labor market is a primary concern for business. According to Area Development magazine’s 32nd Annual Corporate Survey, labor costs and labor availability were two of the top five factors used by businesses to rate a location’s business climate. If the local talent pipeline is unable to supply the number of workers needed by firms, then firms suffer by either having to hire and train less qualified persons, settle for under-qualified persons, or recruit their employees from outside. In the long run, if the local market is unable to supply the required talent, a company may choose to relocate to a location with a stronger labor market. According to Area Development magazine,

The fact that about 90 percent of the Corporate Survey respondents indicate labor costs and skilled labor availability as “very important” or “important” to a location decision must not be understated and offers lessons to both companies wanting to select the optimal site and to communities seeking to grow their economic base and win projects. While incentives, tax structure, high quality of life, and access to customers/markets are always key project drivers, a community that does not have the adequate labor profile is devastating to a project’s success in that location, and also limits the economic developer’s ability to successfully compete for a project.

Thus, assessing the impact of local labor market conditions on business operations is critical to understanding Maryland’s basic competitiveness. Firms were asked to characterize the overall labor market in Maryland and the greatest labor market advantage and disadvantage in Maryland.

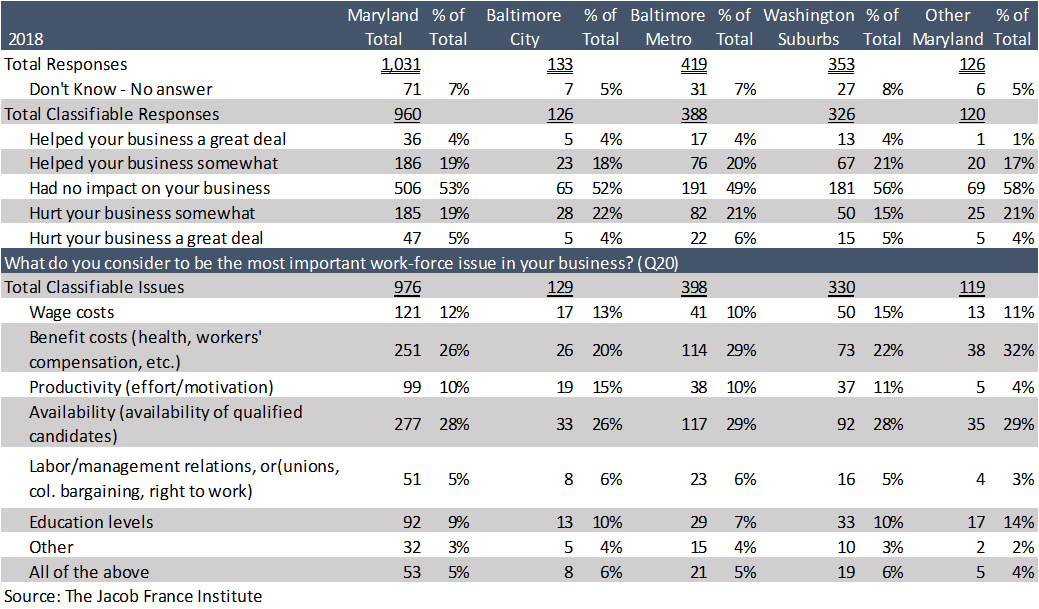

Overall, firms in Maryland are split on the impact of labor market conditions on their business operations, with 23 percent reporting that labor market conditions helped their operations and 24 percent reporting they hurt their operations with 53 percent reporting no impact. When asked to identify the most important labor market issue impacting their business, the key issues included:

-

Labor market availability (the availability of qualified candidates) was identified as the top issue by 29 percent of firms.

-

Benefit costs (health, workers' compensation, etc.) was identified as the top issue by 26 percent of firms.

-

Wage costs (13 percent), worker productivity and education levels (10 percent each) were identified as the third, fourth, and fifth most important issues.

Table 20: Have labor market conditions in Maryland hindered the ability of your business to meet its goals? (Q19 -20)

Worker Shortages

The key issue in assessing a state or region’s labor market competitiveness is whether it can supply the workers with the education and skills needed by the local employer community. To assess this, firms were surveyed on whether they had experienced difficulty in obtaining workers, if these were short-term or long-term worker shortages, the positions for which they experienced difficulty in filling, and if workers had to be recruited from out-of-state. The key findings are as follows:

-

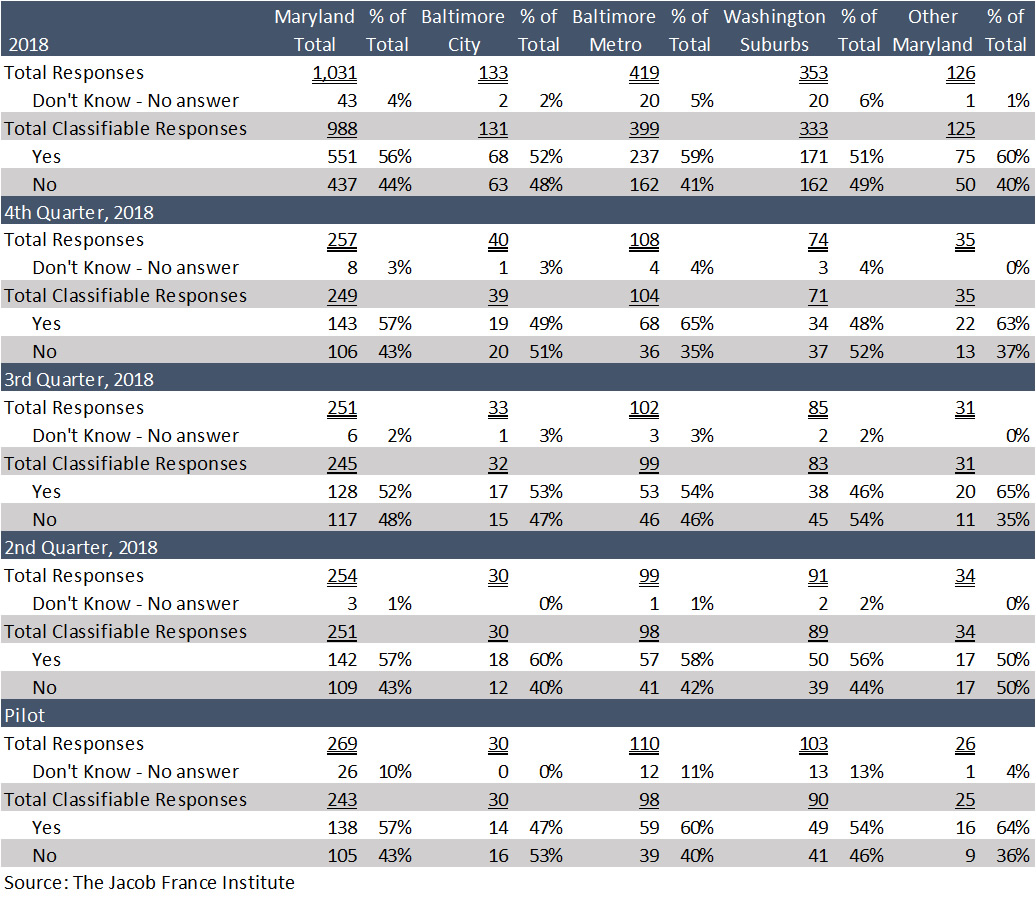

Overall, in 2018, 56 percent of businesses reporting difficulties in obtaining workers with the skills necessary to fill specific job requirements and 44 percent did not.

-

On a quarterly basis, these results held fairly stable over the survey period.

-

The percentage of firms reporting difficulties in finding workers has increased from the 2011 survey (the last year of the survey before this restart) with the economic recovery, increasing from 38 percent of firms in 2011 to 56 percent in 2018.

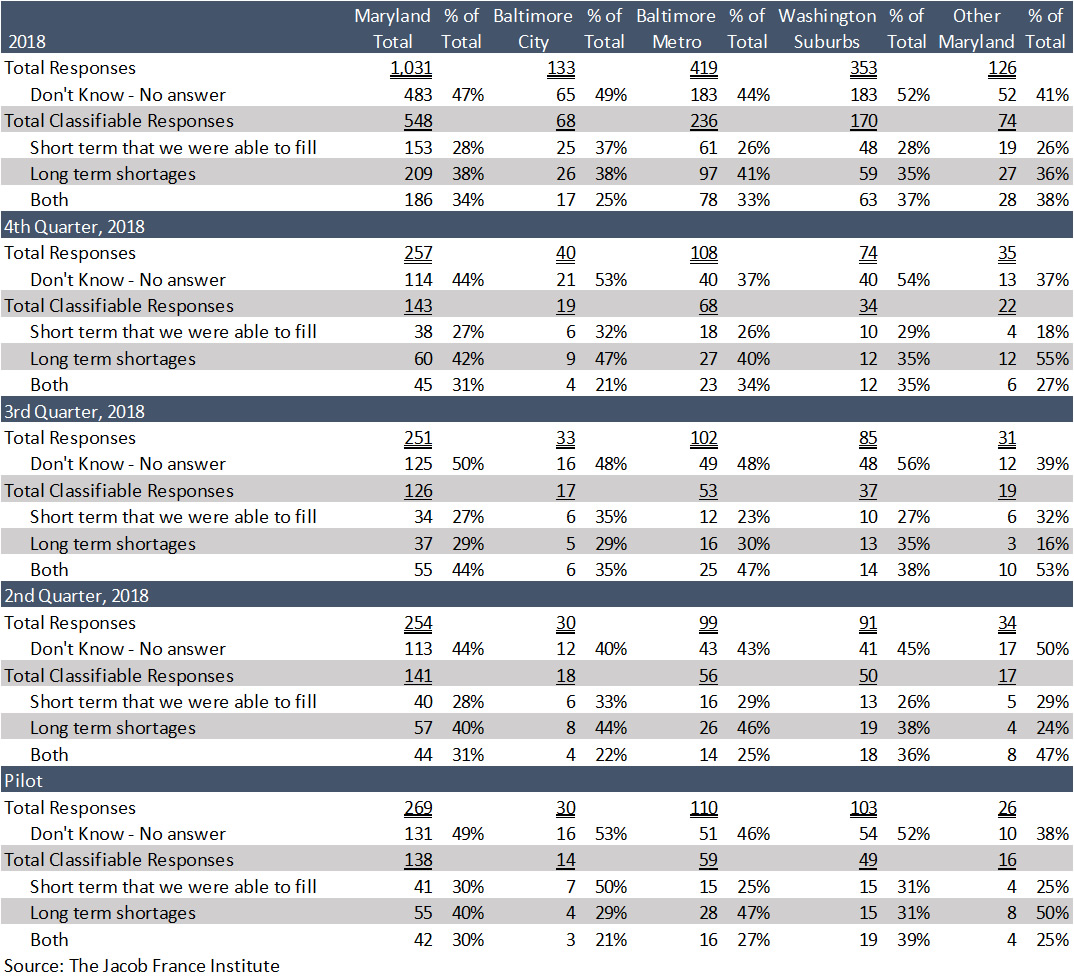

-

Maryland firms appear to be experiencing long-term difficulties in finding the workers needed, with 38 percent of the firms reporting difficulties in obtaining workers experiencing long term shortages and 34 percent reporting both long- and short-term shortages. Thus, 72 percent of firms reporting difficulties in finding workers, or 38 percent of the 1,031 firms surveyed are experiencing either long term worker or both long- and short-term shortages.

-

When asked about what types of workers firms were experiencing difficulties in hiring, Maryland businesses are experiencing workforce shortages across all skills and education levels.

-

At the lower-skill level, 21 percent of responding firms reported difficulties in finding unskilled workers or laborers.

-

At the middle-skill level, 30 percent of responding firms reported difficulties in finding manufacturing or skilled workers. One middle-skill area that stood out in the survey was transportation/warehousing and commercial drivers, with 6 percent of responding firms reporting difficulty in finding these workers when asked to identify other occupations where they are experiencing difficulties in finding workers

-

At the higher-skill level, 18 percent of responding firms reported difficulties in finding engineers or scientists and 10 percent reported difficulties in finding computer programmers or analysts.

-

-

When asked about steps required to address workforce shortages, 44 percent of responding firms reported that forced to recruit workers from out of state and 8 percent reported that they were forced to recruit workers internationally using an H1B visa or other method. The number of firms recruiting from out of state and internationally is actually down from the 2011 survey, despite a larger number of firms reporting facing workforce shortages.

-

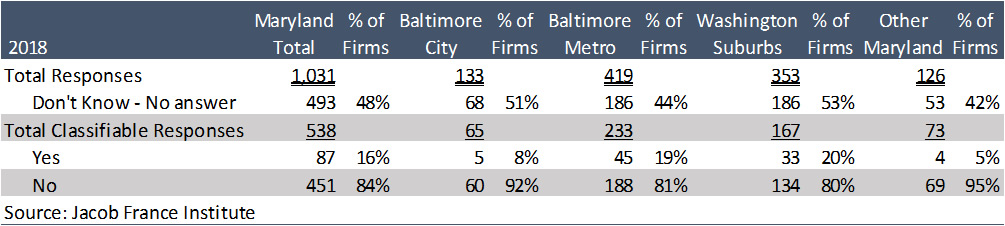

Sixteen percent of firms reported that they experienced difficulty in hiring workers with a security clearance, up from 11 percent in 2011, indicating the growth of Maryland’s cyber- and national security business base.

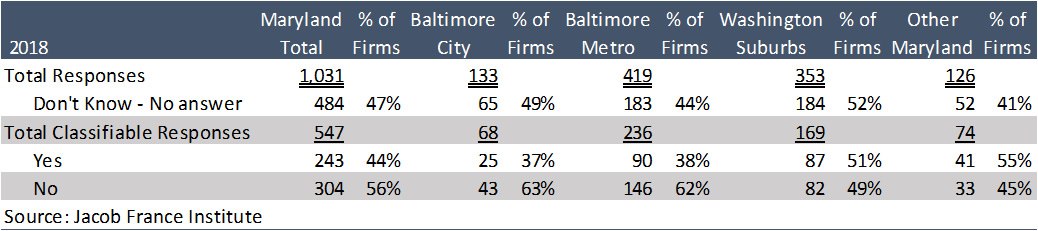

Table 21: In the past year, has your company experienced difficulties in obtaining workers with the skills necessary to fill specific job requirements? (Q37)

Table 22: Were these short-term shortages that you were able to fill eventually, or long-term shortages of workers in specific categories, or both? (Q37b)

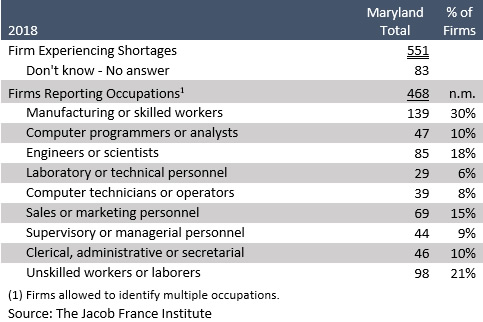

Table 23: For what types of positions did your company experience difficulties in recruiting? (Q37c)

Table 24: To recruit experienced workers, were you forced to recruit workers from out of state? (Q37d)

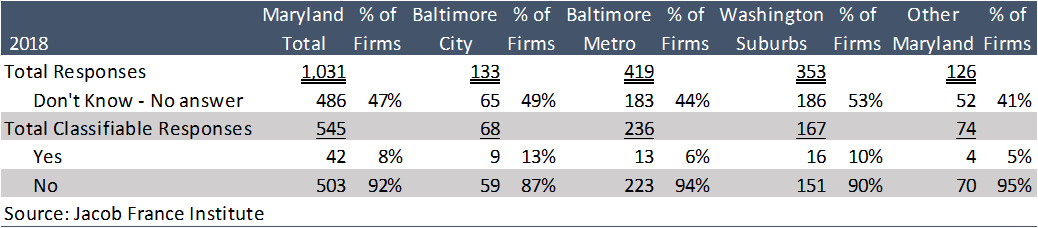

Table 25: To recruit experienced workers, were you forced to recruit workers internationally

using a H1B visa or other method? (Q37e)

Table 26: Have you experienced difficulty in recruiting workers with a security clearance? (Q37f)

Maryland Educational Institutions

Maryland businesses have a positive view of Maryland’s educational institutions. The local workforce development system is made up of K-12 educational systems, community colleges, private training institutions, and four-year colleges and universities. These educational and training institutions provide a pipeline of new workers required by the employer community.

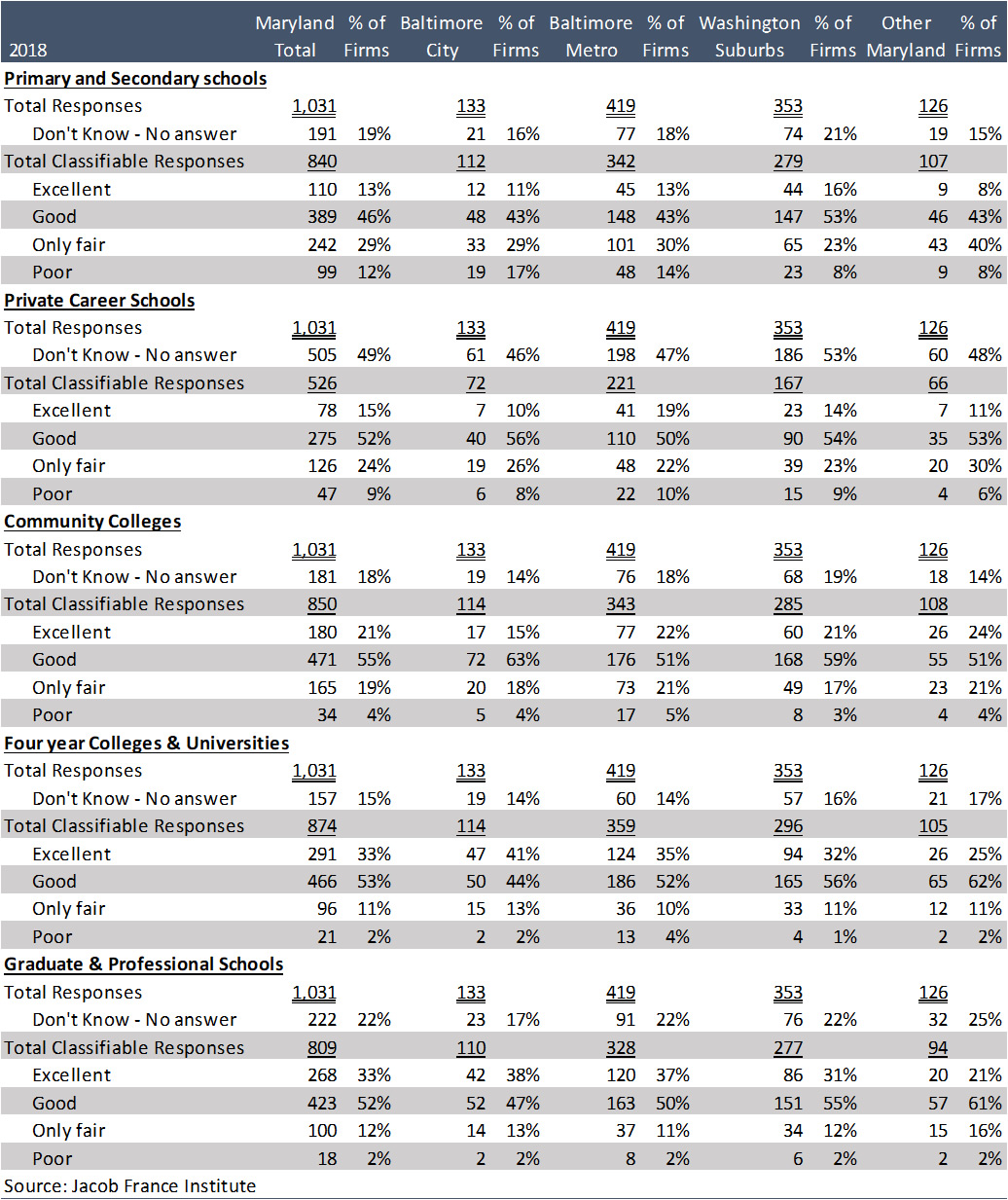

Firms were asked to rate the effectiveness of Maryland’s educational institutions in providing a skilled and educated workforce. Maryland’s educational institutions were grouped into five categories: primary and secondary schools, private career schools, community colleges, four-year colleges and universities, and graduate and professional schools. Responses were categorized as being excellent, good, fair, or poor. Overall, firms rated Maryland’s colleges and universities and its graduate and professional schools as the best, with the overall responses being:

-

Primary and secondary schools: 46% of firms rated these schools as being good and 13% rated them as excellent.

-

Private career schools: 52% of firms rated these schools as being good and 15% rated them as excellent.

-

Community colleges: 55% of firms rated community colleges as being good and 21% rated them as excellent.

-

Four-year colleges and universities: 53% of firms rated these schools as good and 33% rated them as excellent.

-

Graduate and professional schools: 52% of firms rated these schools as good and 33% rated them as excellent.

-

These results are consistent with the results of the 2011 and prior surveys, with firms maintaining a consistently positive perception of Maryland educational institutions over time.

Table 27: How would you rate the effectiveness of the state's educational institutions in providing a skilled and educated workforce that meets the needs of your company? (Q38 a-e)